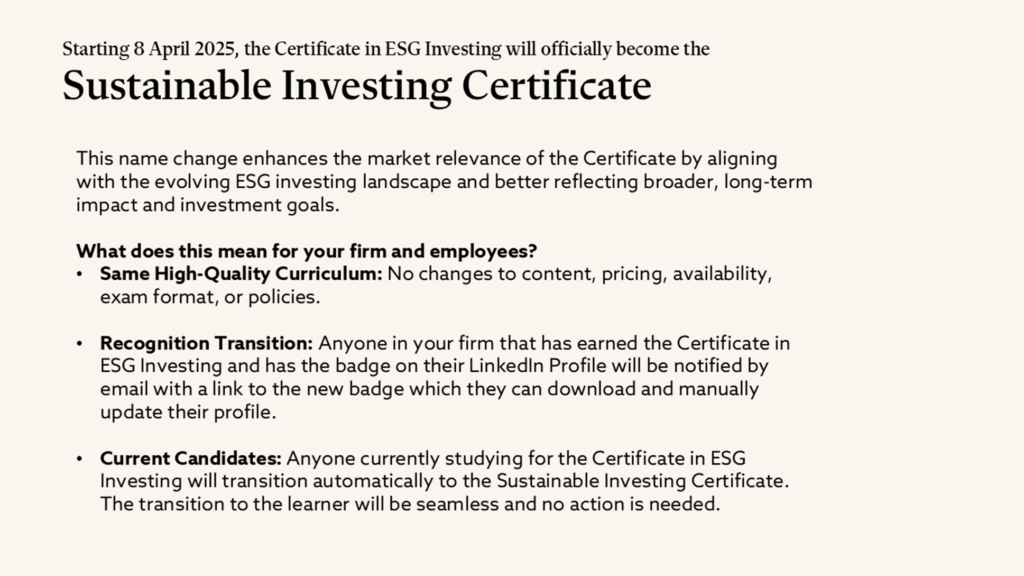

*2025년 4월8일 부로 Certificate in ESG Investing가 Sustainable Investing Certificate으로 이름을 변경하였습니다.

Sustainable Investing Certificate overview

지속가능투자 자격증이란?

Sustainable Investing Certificate은 투자 의사결정 과정에 ESG 요소를 효과적으로 통합할 수 있는 핵심 역량을 제공합니다.

온라인 학습을 통해 환경·사회·지배구조(ESG) 요인을 분석하는 전문 지식을 습득하고, 조직 내에서 지속가능성 분야의 전문 인재로 성장할 수 있습니다. CFA Institute가 주관하는 글로벌 자격증으로, ESG 요인을 투자 과정에 통합하기 위해 투자 전문가에게 필요한 표준화된 지식과 실무 역량을 제공하며, 빠르게 성장하는 지속가능 금융 분야에서 커리어 확장의 기회를 열어줍니다.

The Sustainable Investing Certificate equips you with the skills to incorporate ESG factors (environmental, social, and governance) into your investment decision-making process – capabilities that are increasingly essential in today’s market.

Through comprehensive online learning, you’ll develop the knowledge base to analyze environmental, social, and governance considerations, positioning yourself as a sustainability expert in your organization. Backed by CFA Institute global recognition, this certificate opens doors to career advancement in the rapidly growing field of sustainable finance.

This certificate is part of our sustainability learning path. Take a look at our full range of sustainable investing programs.

- 시험 등록비: USD 890

- – 시험 1회 응시료 및 온라인 학습이용권 포함

– 학습자료 Hard Copy 구매: USD 135 (국제배송비 별도) - 시험 응시 일정을 변경할 경우 USD 30의 변경 수수료가 부과됩니다. (단, 시험 예정 시간으로부터 72시간 이내에는 일정 변경이 불가합니다.)

- – 시험 1회 응시료 및 온라인 학습이용권 포함

- 시험 응시기간: 시험 등록 후 6개월 이내

- 시험 총 문항: 100문제(선다형 및 객관식)

- 권장 학습 시간: 100시간

- 평균 합격률: 60% – 70%

- 시험 시간: 2시간 20분

- 시험 응시 방법:

- Prometric 시험센터 및 OnVue 온라인 감독시험

- Am I eligible for the certificate? There are no formal entry criteria, but it is recommended that candidates have knowledge and grounding in the investment process. Please note there is a study commitment of 100 hours on average.

- How do I take the exam? You will have one year from registration to schedule and take your examination. You can take the exam at a Prometric test center, or through remote proctoring if available in your country.

- What will I receive once I register? Registration includes the first exam sitting, a mock exam and access to online learning materials via a secure platform. This information will be provided to you upon confirmation of your registration.

Chart Your Next Move with CFA Institute

Get more information about the Sustainable Investing Certificate and what it can do for you, delivered straight to your inbox.